Creative commons / Unit 5 / CC-BY-SA 3.0

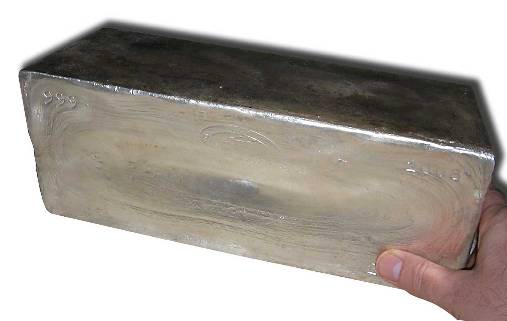

The prices of silver kept on rising in mid-July and reached about $40.55 per ounce. However, spot silver prices fell on July 19 and touched $39.53 per ounce because of cut down by $1.022. Many analysts believe that another reason for fluctuating silver price is due to investors’ reactions who are concerned about the approaching August 2 deadline for the Eurozone debt, the US debt ceiling and the US Federal Reserve hinting at the third round of quantitative easing (QE3). As a consequence of the market scenarios, the prices of silver might be changing. However, the long-term prospects for valuable metals just like silver are profitable because of debt and loose monetary policies, which are there to stay.

Jamie Greenough, an investment advisor with Global Securities Corporation, said that the prices of silver have not stayed stable for the year. The market saw a drastic fall in the silver prices after April 25, when silver traded at $49 per ounce. The silver market was basically influenced as a result of raising margins by the CFTC. In the future, it can pave a new way to reestablish its base and fulfil the requisite demand. As a matter of belief, the silver will develop a strong base with the price of around $35 per ounce.

China is the leading importer of silver in record quantities and will continue to do so in upcoming years. In 2010, the overall import of silver in China reached about 3500 tonnes. This will not go down unless China will keep importing silver in record quantity. There are three sectors, industry, jewellery and investment, where the demand for silver is increasing. However, the industry has the highest demand for silver, adding up to around 70%.

After China, another country is on the same race track when talking about the demand for silver. In 2010, India imported about 2800 tonnes of silver. The rural sector particularly saw the investment in silver. In future, the demand for silver is expected to grow by about 5,000 tonnes. Hence, these two nations will increase the demand for silver up to 30%. As a result of the market uncertainties, investors look forward to focusing on silver to compensate for huge market losses.