Credit: Piqsels

Gold vs Silver – Which of the precious metals are a better investment? The answer depends on individual choices, which are most often based on many factors.

Some factors include affordability, storage, etc. Here’s a brief analysis of gold vs silver in light of various investment implications.

1. Affordability

Silver is reportedly much more affordable for an average investor than its precious metal counterpart – gold. Physical silver captures nearly the same benefits as gold; like being a hard asset, silver is used in coinage more than gold and having limited counterparty risk or default risk.

2. Price Volatility

Silver’s price is reportedly more volatile, and investors need to be prepared emotionally for this aspect. So, it would not make sense to buy and sell the metal with fierce changes. Also, historically silver has fallen more in bear markets than gold and risen more in bull markets than gold. Hence, buying during a bull market will reportedly get greater returns than gold. It is also expected that silver’s volatility factor would perform better than gold in the upcoming bull market.

3. Industrial Use

Silver’s unique traits make the usage more beneficial in industry, reiterated by a 56% supply to the industry against 12% of gold supply. There are multiple applications of silver, ranging from electronics to medical applications. It is observed that in a strong economy, the demand for silver is higher than during a recession or deflation.

4. Storage

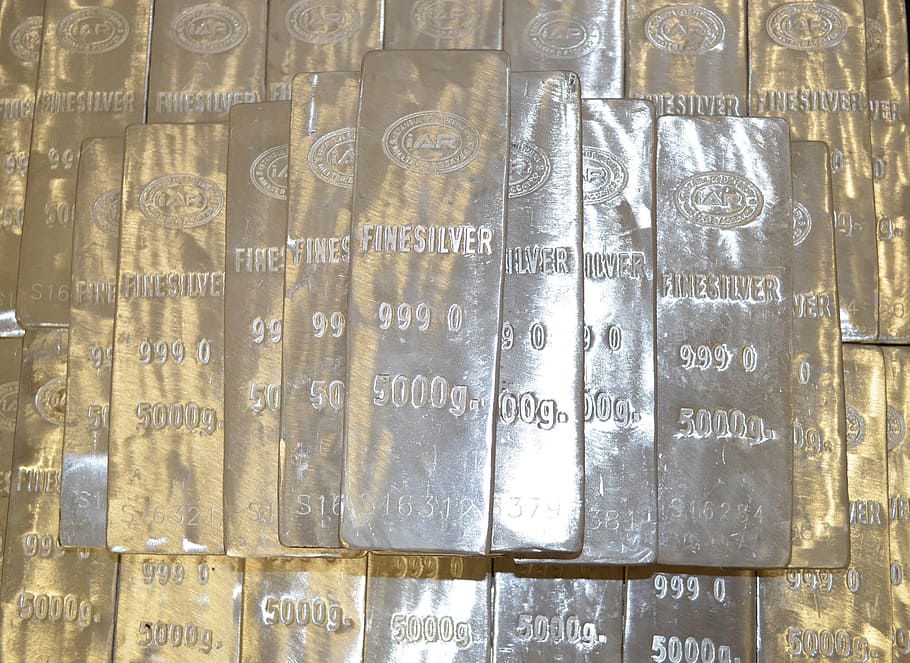

Silver takes more space than gold when it comes to storage space, which transcends transporting physical silver, as it gets more difficult, cumbersome, and expensive. Also, silver coins and bars against gold are expected to be stored in a dry place with no exposure to elements to tarnish.

5. Stockpiles

The transition of governments no longer holding stockpiles (or having a very small stockpile) of the white precious metal also has its own implications. In fact, central banks prefer to buy and hold a lot of gold instead.