Creative commons / Unit 5 / CC-BY-SA 3.0

The London Bullion Market Association operates the world’s largest venue for trading silver. It has organised an over-the-counter market for buyers and sellers to negotiate the contracts with each other.

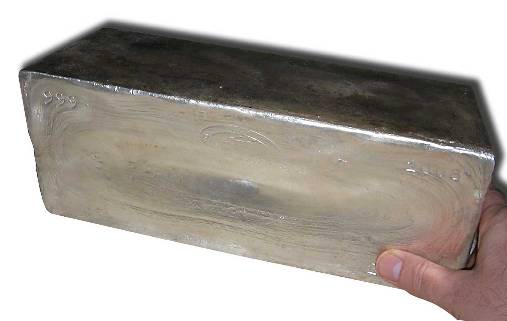

Its members include major bullion banks, refiners and their customers. In this market, contracts are for 1,000 oz bars refined to a minimum of 0.999 purity, although the minimum contact is for 50,000 ounces in general.

In the London metal exchange, only long-term buyers and sellers of silver trade. As a result, executed contracts have the prompt delivery of the physical metal.

About 10 days ago, when the silver price climbed $30, the demand on the exchange also soared up. Members made two heavy purchases, each in the range of 5-10 million oz during that time. To execute several contracts, sellers couldn’t accumulate enough physical silver. However, the LBMA always insisted that the delivery of silver should take place through the exchange rather than the third party.

After some time, a report came to light that there is no physical silver for immediate delivery in London. Therefore, the future delivery of silver depends on assumption.

JPMorgan Chase increased the price up to $31, which shows how much it is interested in paying to purchase physical silver. On the other hand, banks are also paying so far as $31 per ounce, but they expect short-to-intermediate term prices to go beyond this level.

Despite all things, premiums on the coins and bars are not rising as the contracts traded under the guidelines of the LBMA are set at a lower premium than any other form of physical silver.