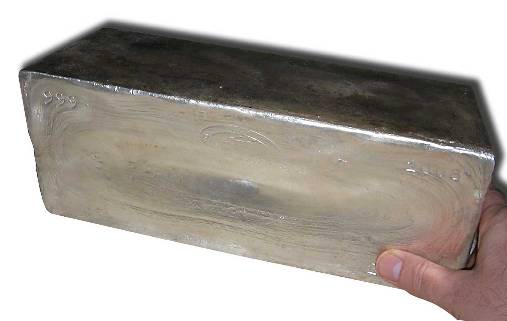

Credit: Unit 5 / CC-BY-SA 3.0

Many investors have been turning to metals with equities being so high and interest on bonds or bank deposits being so low. But it is not only about looking for a higher return but also about diversifying a portfolio properly. Thus, it comes as no surprise that silver investment has become increasingly appealing and interesting to consider. Yet, is there such a thing as the best time to buy silver?

To provide the best answer to that, it is best to look at the historical prices of silver. If you do just that, you will realize right away how different silver is from gold. Actually, silver prices have not had nearly such a roller coaster ride like gold did. During the last 12 months, it moved from $17 per troy ounce to $20 and then back down to the lows of around 15 before it starts to settle down currently at the $17 level again. This points out that silver has smaller volatility than gold, which moved all over the map, from a high of $1700 to a low of $1100 per troy ounce. A lower volatility means that silver is a much safer investment than gold may be.

This last 12-months price movement also means that silver has set a firm $15 support line tested 3 times with market-moving swiftly up from those points. It also means that right now, with prices being at just north of $17, it might be the right time to do some investing in this metal. Prices seem ready to move up to test an upper band or resistance the way technical analysts would like to call it, which is those $20. Even if the market does not go above that area, $20 is still over 15 % higher than where it is right now.

There are many different ways to invest in silver. Investors can purchase coins or silver bars, much like gold investors do. This can later can be sold to respectable dealers but incur the cost of storage and delivery. They can also buy it as a financial instrument through their broker in futures or spot contracts. But these can carry elevated risks since one can purchase them on very low margins. Or they can also choose to invest in silver ETF, which might be the best way to combine a further appreciation of the stock market and the future rise of the metal itself.