Credit: Pixabay

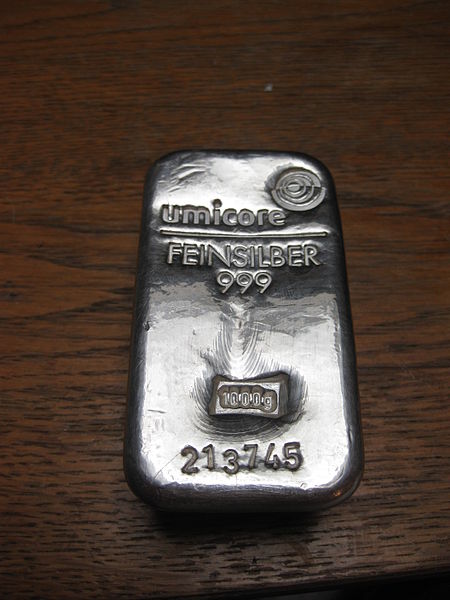

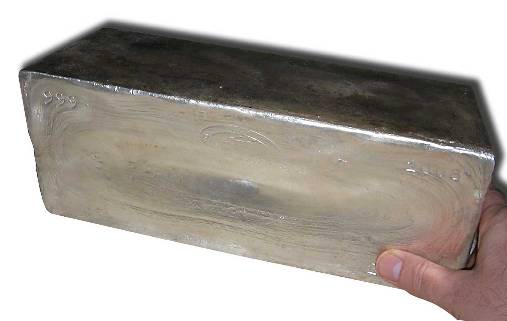

Silver prices hitting $20 per ounce leave the market speculating how much silver will rise in 2016. Due to the overall economic scenario globally and especially after Brexit, silver has had double the percentage gain compared to gold. Continue reading