Credit: PD Photo

Investors in Kentucky who deal in gold and silver bullion and coins feel that the state is double taxing them with a 6 % sales tax.

State Sen. John Schickel, R-Union, has necessitated the need to exempt precious metal bullion or legal tender coins from the state’s sales tax levy. Gold, silver and other precious metal investors pay a sales tax beforehand plus capital gains tax when they sell it.

Schickel argued that the investment in precious metals should be treated like stocks and bonds where sales tax doesn’t apply.

However, the recessive economy of Kentucky has lawmakers finding ways to cut tax exemptions rather than create additional tax breaks.

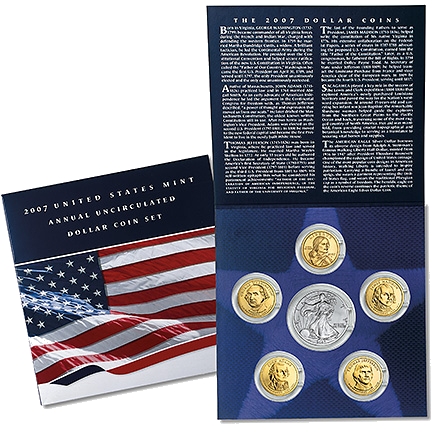

According to Schickel, gold and silver is a stable investment and acts as a hedge against inflation. It should not be treated and taxed any differently from other investment options. The bill proposed by Schickel is considering exemption of bullion and money from precious metals minted by the U.S. and foreign government. Jewellery or commemorative coins minted by private firms are not counted in this exemption.

“It seemed to me to be a discouraging investment in precious metals,” Schickel said. “For people that are making investments of these kinds, we want Kentucky to be a friendly place to live.”

Boone County Clerk Kenny Brown, who brought the issue to Schickel’s attention, said, “For the individual investor, I believe it is unfair. If I buy $1,000 worth of P&G stock, I don’t get taxed on sales. It is an unfair tax on investment. If you are looking to preserve value, gold and silver are good investments. People are looking for things not as volatile.”

Coin dealers debate that Kentucky would have an advantage with the sales tax exemption. There would be increased revenue from investors who are presently buying on the internet or in states with no sales tax.